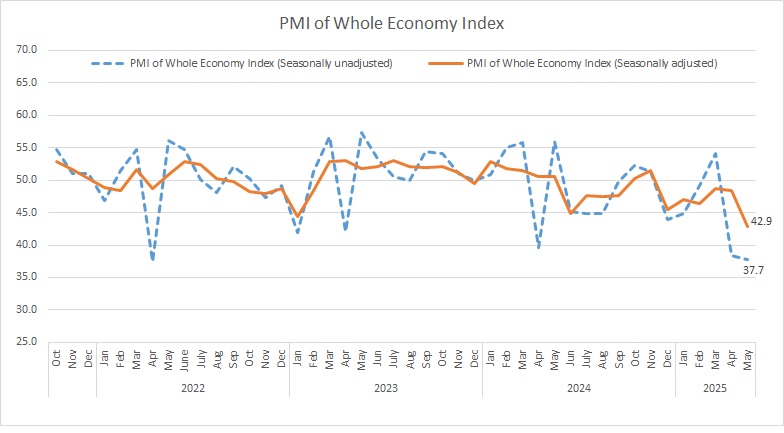

Iran Chamber of Commerce, Industries, Mines, and Agriculture (ICCIMA) has released the country’s new PMI data for the fiscal month of Khordad (May 22 – June 21, 2025) showing a return to contraction after marginal growth in the previous month.

The seasonally adjusted composite PMI fell to 42.9, well below the neutral 50 threshold that separates expansion from contraction. This figure marks one of the lowest levels recorded in the index’s history and the weakest reading in the past 62 months. The downturn is attributed primarily to prolonged power outages affecting production, the 12-day Israeli-imposed war on Iran, and the ensuing economic uncertainty.

Seasonal adjustment, or deseasonalization, is a statistical method used to remove the seasonal component from a time series, allowing for the independent analysis of trends and cyclical deviations. After preparing dozens of PMI (Purchasing Managers' Index) reports, the Research Center of Iran Chamber of Commerce, Industries, Mines, and Agriculture has now identified the seasonal components of these time series and prioritized seasonal adjustment in its monthly PMI reports.

The Statistics and Economic Analysis Center of Iran Chamber of Commerce, Industries, Mines and Agriculture, the sponsor and coordinator of the survey, announces the whole economy PMI data in a report every month.

The headline PMI is a number from 0 to 100, such that over 50 shows an expansion of the economy when compared with the previous month. A PMI reading under 50 indicates contraction and a reading of 50 implies no change.

PMI is an index of the prevailing direction of economic trends, aiming to provide information about business conditions to company directors, analysts and purchasing managers.

Click on the image for better view

Key components of the survey reflect worsening conditions across multiple sectors:

-New orders hit their lowest level in 63 months, not seen since April 2020.

-Inventory levels of raw materials and purchased supplies remained below the neutral threshold for the 15th consecutive month, with the rate of decline intensifying compared to the previous month.

-Employment levels dropped significantly, recording their lowest level in 63 months, again dating back to April 2020.

-The cost of raw materials and purchased items increased compared to the previous month, marking the highest rise in the past four months.

-Export orders stayed in contraction territory for the 14th consecutive month, although the rate of decline slightly eased.

-Sales of goods and services fell to their lowest level in 32 months, last seen in November 2022.

|

INDEX

|

Farvardin1404 (Mar-Apr2025)

|

Ordibehesht1404 (Apr-May2025)

|

Khordad1404 (May-June2025)

|

|

PMI (seasonally adjusted)

|

48.4

|

50.3

|

42.9

|

|

business activities

|

50.3

|

48.1

|

45.5

|

|

new orders

|

47.5

|

49.6

|

38.5

|

|

suppliers’ delivery time

|

49.1

|

48.3

|

45.6

|

|

raw material inventory

|

50.2

|

49.1

|

46.0

|

|

employment

|

45.7

|

56.1

|

43.0

|

|

raw materials price

|

70.1

|

76.5

|

77.3

|

|

finished goods inventory

|

49.0

|

47.6

|

48.5

|

|

exports of goods and services

|

44.8

|

42.0

|

44.3

|

|

price of goods and services

|

59.9

|

61.2

|

59.9

|

|

consumption of energy carriers

|

54.2

|

57.8

|

43.7

|

|

sales of goods and services

|

50.1

|

52.6

|

43.2

|

|

expectations for next month economic activities

|

52.3

|

53.1

|

53.8

|