A “high-level” European delegation of experts is expected to visit Iran in "near future" in a bid to iron out details of the special payment channel INSTEX that was created in January, designed to ease flow of essential humanitarian commodities into Iran in the wake of US sanctions, Iran Foriegn Ministry said.

“A European delegation that has the responsibility of INSTEX will visit Tehran in near future to hold talks [about the mechanism],” said Bahram Qasemi, Iran Foreign Ministry Spokesman on Monday. However, he didn’t say when exactly the team will travel to Tehran.

Experts from both sides will talk about “steps needed to implement the mechanism and finalise it”, according to the official.

He added that “good” expert-level talks on economic and banking matters have been held between Iran and Europe in the past weeks. He could be referring to recent negotiations between Iranian Deputy Foreign Minister Abbas Araqchi and senior French officials that were held in Paris.

Deputy Iranian Foreign Minister Abbas Araqchi, (right middle) hols talks with French officials in Paris early February (Photo: IRNA)

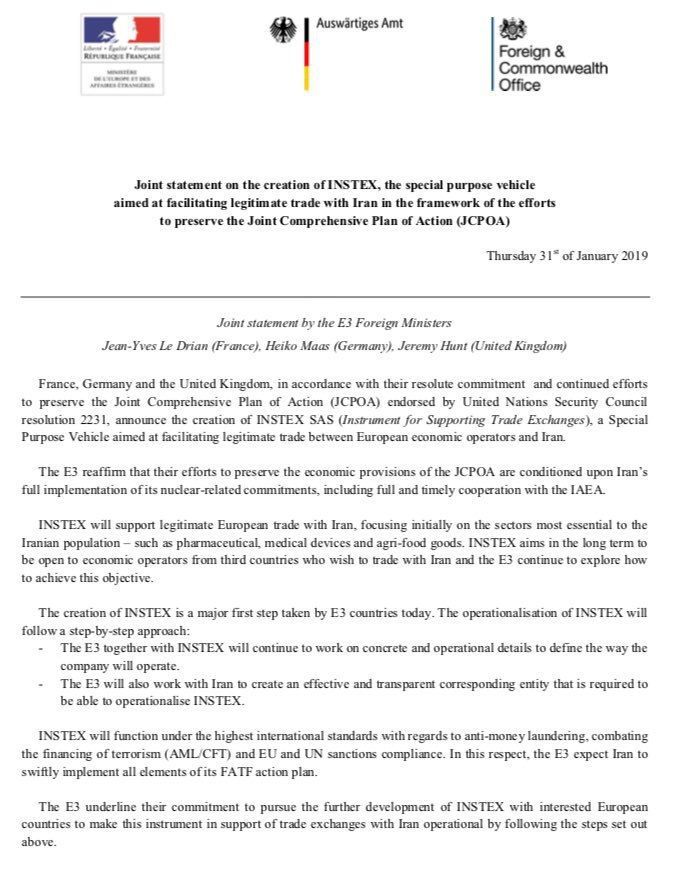

INSTEX (Instrument in Support of Trade Exchange) was created on 30 January by the British, French and German foreign ministers in the Romanian capital Bucharest. The financial channel, earlier called Special Purpose Vehicle (SPV), is a response from the three European (E3) signatories to the 2015 international nuclear deal with Iran to the unilateral US sanctions that have choked monetary transactions with the Middle Eastern country.

President Donald Trump Administration withdrew the US from the multilateral treaty last May and reimposed two rounds of sanctions on Iran’s vital oil and banking sectors.

However, this specially-designed vehicle, that is supposed to facilitate trade of pharmaceuticals, medical devices and agri-foods, has not been implemented so far. This company has been registered at the address of the French Economy and Finance Ministry in Paris. German banker Per Fischer has been reportedly chosen for a period of six months to run it. Also, a senior UK diplomat is expected to head the Supervisory Board.

Former Commerzbank manager Per Fischer

“We haven’t reached the stage in which we can say that this mechanism does certain job,” stressed Qasemi who went on to say that European delegation’s visit could help “take bigger steps in this regard”.

The Iranian Foreign Ministry spokesman noted that both Iran and the three European states “have had the necessary will to include European officials in the delegation”. However, he reiterated that “senior expert-level talks are needed to coordinate the two mechanisms and make it operational. I think it would be a high-level delegation of economic and technical experts,” he added.

Last week, the Central Bank of Iran (CBI) announced that is will “soon” unveil a similar company to INSTEX, saying “it’s being created”. On the day of its creation announcement in Bucharest, the French Foreign Minsitry published a video in which it explained how the channel could work, highlighting the fact that Iran also needs to put into place its own payment clearance company.

Watch video: how INSTEX works (source: French Ministry for Europe and Foreign Affairs Twitter )

On Monday, the Iranian media published excerpts of a speech by Iran Supreme Leader Seyyed Ali Khameni, delivered on the day of the US withdrawal from the nuclear deal, in which he had called on the Iranian government not to “tie the current economic problems with the European package”, stressing that Tehran shouldn’t “be trapped in the European game”.

Also, the E3 statement said it “expects Iran to swiftly implement all elements of the Financial Action Task Force (FATF) action plan”.

A screenshot of the the E3 following the annoucement of INSTEX creation

The Iranian official stressed that “under current situations, it’s much better that Iran joins the convention rather than not being part of it”. “These tools -he said- could facilitate our commercial banking ties”.

Earlier, Iran’s Expediency Council approved an anti-money laundering (AML) bill.

Two more bills, on Combating the Financing of Terrorism (CFT) and joining the Palermo Convention are still being debated. On Saturday, the council postponed its final decision, saying it will be announced after the Persian New Year holidays that run from 21 March to 6 April. The FATF has given Tehran until June to fully enforce the outstanding bills before it zeros in on the country’s financial transactions.