Central banks of Iran and Iraq have agreed to set up euro and dinar accounts in a bid to ease financial transactions between the two countries in the face of restored US sanctions.

“Based on the agreements, Central Bank of Iran (CBI) will open accounts in euro and Iraqi currency dinar at the Central Bank of Iraq in a bid to clear outstanding debts and future payment of Iran oil and gas exports," said Abdolanser Hemmati, governor of Central Bank of Iran after signing agreements with his Iraqi counterpart Ali al-Alaq in Baghdad on Wednesday.

Baghdad got a 90-day waiver from the US Treasury Department on 21 December to keep buying Iranian gas, power.

Iraq relies heavily on Iranian gas to feed its power stations, importing roughly 1.5 billion standard cubic feet per day via pipelines in the south and east, Reuters reports. This amount equals 200 million dollars, according to Iranian Petroleum Minister, Bijan Zanganeh. However, Tehran has not been able to repatriate the money following the reimposition of secondary US sanctions that have targeted international banking relations with Iran.

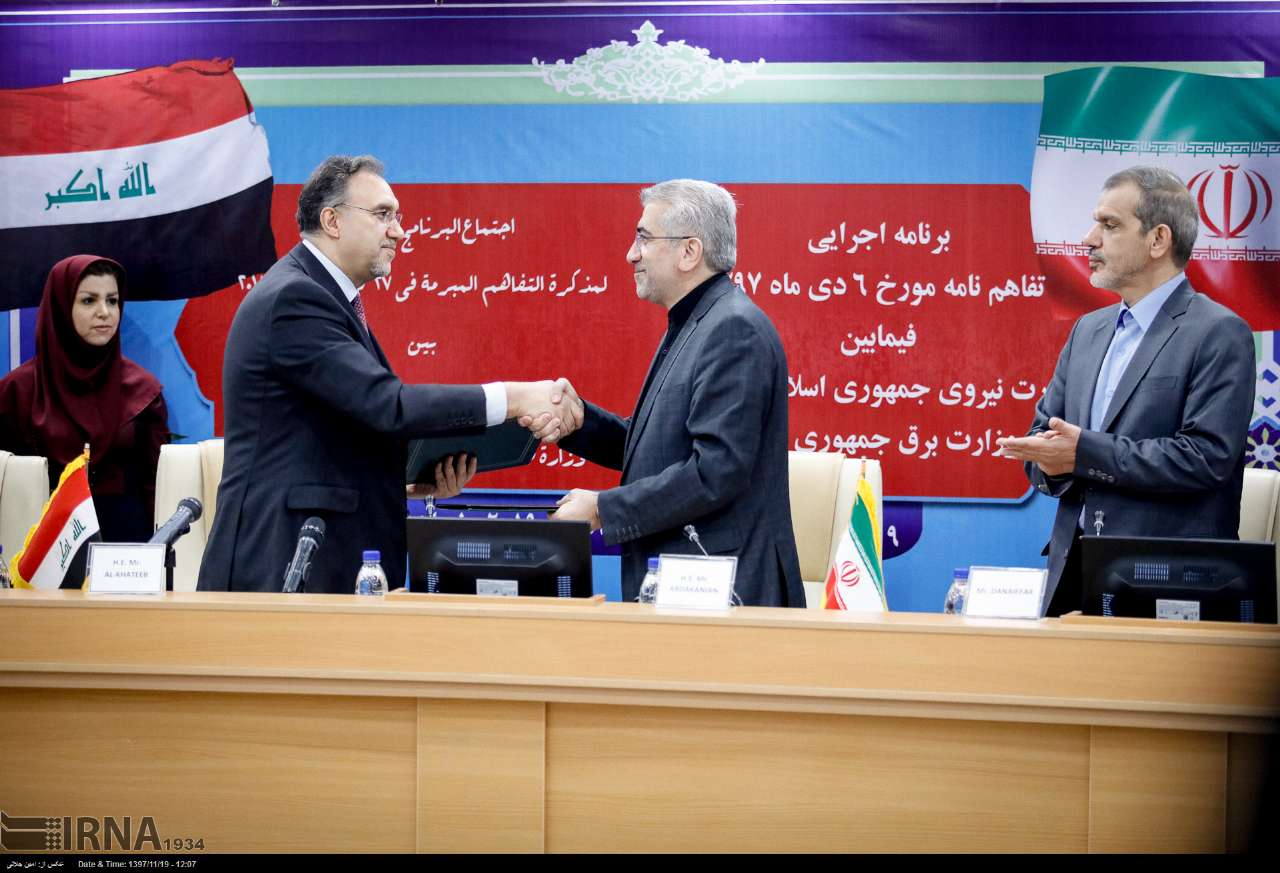

At the same time that Iranian financial chief was in Baghdad to seal crucial banking deals, Iraq’s Electricity Minister Luay al-Khatteeb held talks with Iran Power Minister Reza Ardakanian in Tehran to renew an agreement to import Iranian electricity.

Under the renewed deal, Baghdad buys 1,200 megawatts of power from Iran annually. The power is exported through three transmission lines in Basra, Diyala and Amara that connect Iraqi grid to the Iranian power lines.

Iraqi Electricity Minister, Luay al-Khateeb (left) shakes hands with Iranian Energy Minister Reza Ardakanian following renewing Iran-Iraq power agreement in Tehran (Photo: IRNA, Amin Jalali)

Iran’s power export to Iraq dates back to 2005 when under the first deal Iran agreed to send supply 150 megawatts of electricity to the neighbouring country.

Iran’s Petroleum Minister Zanganeh says Iraq’s debt for gas and power imports stand at 2 billion dollars.

Iran is seeking to become an energy hub and reach other regional countries through Iraq. Iranian President, Hassan Rouhani, had earlier called on his government to pursue what he calls "power diplomacy". Iran has been also supplying power to its neighbours such as Iraq, Afghanistan, Pakistan and Armenia. The state firm Iran Power Generation and Transmission Company (Tavanir) says it’s ready to increase the current amount two-fold.

Securing Iranian businesses interests

Iranian exporters have been dominating the market worth nearly 8 billion dollars per year, according to Hassan Danaifar, secretary of the committee to develop Iran’s economic relations with Iraq and Syria.

Following four hours of crunch talks in the Iraq capital, Hemmati, Central Bank of Iran Governor, announced that Iranian exporters can use Iraqi banks to handle their money. “Also, Iranian banks can have dinar accounts in Iraqi banks in line with the policy to strengthen and develop economic relations between the two countries,” he added.

Hemmati, who has had negotiations with high-level Iraqi authorities such as the president, prime minister and finance minister, among others, said that Iraqi firms can open dinar accounts in Iranian banks as well.

The official, who also chairs the Money and Credit Council of Iran, a a top financial decision-making body with the Central Bank, held meetings with various Iraqi bank chairmen as well as businessmen in Baghdad.

During the talks, Rashad Khudair Wahid, Director General of the second largest Iraqi bank, Rasheed Bank, said he’d like to open a branch in Iran. “I agree with the opening of Iraqi banks branches in Iran because I believe they will help improve this chain,” Hemmati added.

The new payment mechanism comes less than a month after Iranian Foreign Minister Mohammad Javad Zarif visited Iraq, holding talks with wide-ranging Iraqi authorities to consolidate bilateral relations between the two neighbouring countries.

Iran has been pursuing to cement political and economoc relations within its neighbours, regional countries as well as Russia, China and India to lessen the effect of punitive US measures on its economy.

Three European countries, Germany, France and Britain who have remained in the 2015 international nculear deal with Iran, annoucned the creation of INSTEX (Instrument in Support of Trade Exchange), a euro and rial-based payment channel to allow the export of vital commodities, pharmaceuticals and medical devices to Iran. It could take up to a year to become operational.