Iran managed to decrease the size of its foreign debt by around $300 million in a nine-month period ending in December last year, a new report shows.

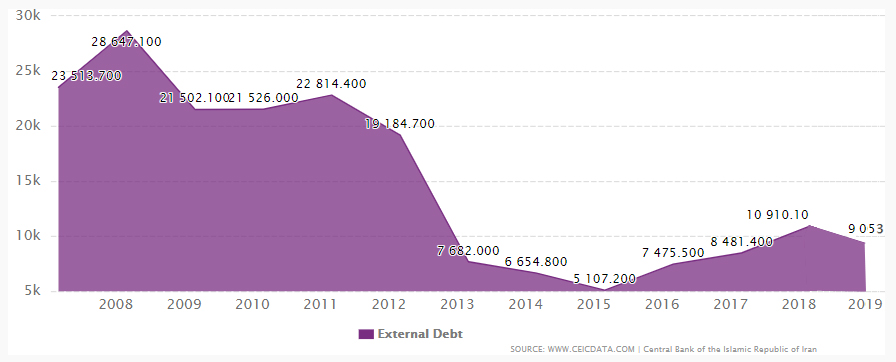

The report by the official IRNA agency cited data by the Central Bank of Iran (CBI) as showing that the total foreign debts stood at $9.053 billion on December 21, 2019, a decrease of three percent compared to March 2019.

That comes as debts had reached $9.339 in March last year but then decreased by seven percent to $8.678 billion in June.

The current actual foreign debts are comprised of $1.505 billion in short-term debts and $7.548 billion in long-term ones, said the CBI.

Iran’s ratio of foreign debt to gross domestic product, which is currently around $500 billion, is among the lowest in the world.

The low level of debt comes as the country has seen its normal oil revenues significantly slashed as a result of the American sanctions.

In a bid to offset the impacts of the US sanctions, the government has been pressing ahead with various programs to diversify the economy away from oil.

A draft budget for the next Iranian calendar year which starts in late March has significantly reduced the share oil-related receipts by introducing new sources of earning hard currency, including a massive plan for export of minerals and petrochemicals.

The CBI said in September 2019 that its own foreign currency reserves had decreased by 1.5 percent compared to June 2019 to stand at nearly $40 billion.

However, it said at the time that total foreign exchange reserves owned by the CBI and credit institutes other than official banks in Iran had risen by 13 percent to top nearly $82 billion