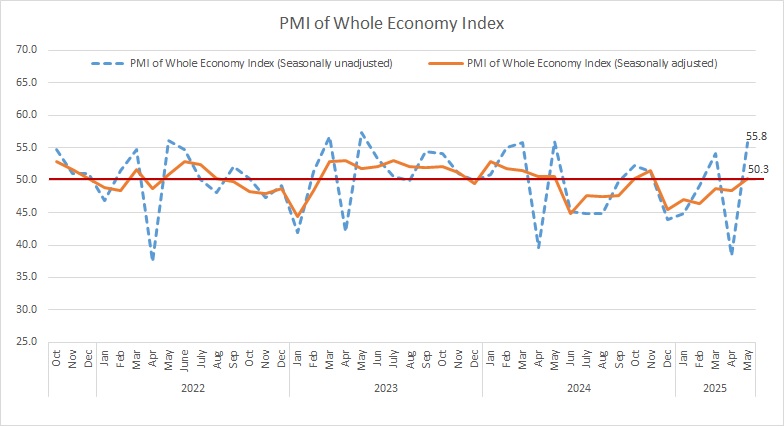

Iran Chamber of Commerce, Industries, Mines, and Agriculture (ICCIMA) has released the country’s new PMI data for the fiscal month of Ordibehesht (April 21 – May 21, 2025) showing minimal growth after prolonged slowdown.

The seasonally adjusted PMI was reported at 50.3 which is slightly above the 50 mark that separates growth from contraction. The marginal increase suggests that while business activity is no longer in contraction, the recovery remains tentative, with weak underlying demand and persistent structural challenges continuing to weigh on sentiment.

Seasonal adjustment, or deseasonalization, is a statistical method used to remove the seasonal component from a time series, allowing for the independent analysis of trends and cyclical deviations. After preparing dozens of PMI (Purchasing Managers' Index) reports, the Research Center of Iran Chamber of Commerce, Industries, Mines, and Agriculture has now identified the seasonal components of these time series and prioritized seasonal adjustment in its monthly PMI reports.

Although expectations were high for improved economic conditions this month, frequent power outages emerged as a major obstacle to production, significantly disrupting operations across multiple sectors.

In addition, shortages of raw materials, rising production costs, declining consumer purchasing power, and tight liquidity conditions have placed further pressure on manufacturers. These challenges, compounded by currency-related constraints, have led to lower output volumes, a drop in new orders, and restricted export capacity.

The Statistics and Economic Analysis Center of Iran Chamber of Commerce, Industries, Mines and Agriculture, the sponsor and coordinator of the survey, announces the whole economy PMI data in a report every month.

The headline PMI is a number from 0 to 100, such that over 50 shows an expansion of the economy when compared with the previous month. A PMI reading under 50 indicates contraction and a reading of 50 implies no change.

PMI is an index of the prevailing direction of economic trends, aiming to provide information about business conditions to company directors, analysts and purchasing managers.

Click on the image for better view

The overall index remained under pressure this month, primarily due to declines in four out of five key sub-indices. Business activities, new orders, suppliers’ delivery time, and raw material inventory all recorded contractions—signaling persistent weakness across the production cycle.

The “business activities” sub-index fell to 48.1, down from the previous month, underscoring a notable decline in goods and service delivery. Respondents pointed to frequent electricity outages as a primary factor disrupting production workflows. In addition, exchange rate volatility not only drove up the cost of imported inputs but also complicated pricing strategies, leaving businesses uncertain about future planning and sales forecasts.

Meanwhile, the “new orders” sub-index declined for the sixth consecutive month, although the pace of contraction slightly eased compared to the preceding month. This sustained weakness is largely attributed to a reduction in consumer purchasing power, driven by high inflation and rising living costs.

The “suppliers’ delivery time” sub index also declined significantly, reaching 48.3, compared to 52.9 a month earlier.

The “raw material inventory” levels also declined over the month. Businesses cited limited access to banking facilities and elevated interest rates as major barriers to financing procurement needs. Compounding the issue, currency instability and soaring inflation have further driven up the cost of both domestic and imported raw materials, weakening firms’ ability to maintain adequate stock levels.

|

INDEX

|

Esfand1403 (Feb-Mar2025)

|

Farvardin1404 (Mar-Apr2025)

|

Ordibehesht1404 (Apr-May2025)

|

|

PMI (seasonally adjusted)

|

48.7

|

48.4

|

50.3

|

|

business activities

|

48.6

|

50.3

|

48.1

|

|

new orders

|

48.6

|

47.5

|

49.6

|

|

suppliers’ delivery time

|

52.0

|

49.1

|

48.3

|

|

raw material inventory

|

46.7

|

50.2

|

49.1

|

|

employment

|

47.6

|

45.7

|

56.1

|

|

raw materials price

|

74.8

|

70.1

|

76.5

|

|

finished goods inventory

|

46.1

|

49.0

|

47.6

|

|

exports of goods and services

|

45.4

|

44.8

|

42.0

|

|

price of goods and services

|

62.6

|

59.9

|

61.2

|

|

consumption of energy carriers

|

52.0

|

54.2

|

57.8

|

|

sales of goods and services

|

54.2

|

50.1

|

52.6

|

|

expectations for next month economic activities

|

51.3

|

52.3

|

53.1

|