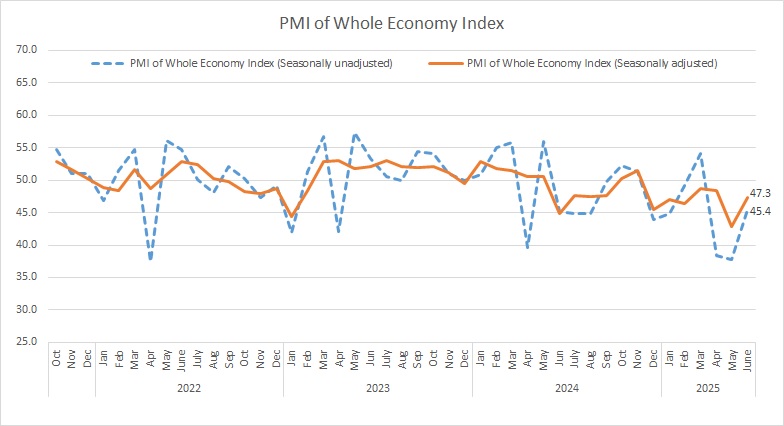

Iran Chamber of Commerce, Industries, Mines, and Agriculture (ICCIMA) has released the country’s new PMI data for the fiscal month of Tir (June 22 – July 22, 2025) which has remained below the 50 threshold that separates growth from decline.

The seasonally adjusted reading (47.3) marked a slower pace of deterioration compared with the previous month, but still pointed to weak business conditions.

Output in both manufacturing and services stayed subdued, with production and service delivery falling for the 16th straight month. The drop in output among industrial firms was described as “noticeable,” according to the survey.

Seasonal adjustment, or deseasonalization, is a statistical method used to remove the seasonal component from a time series, allowing for the independent analysis of trends and cyclical deviations. After preparing dozens of PMI (Purchasing Managers' Index) reports, the Research Center of Iran Chamber of Commerce, Industries, Mines, and Agriculture has now identified the seasonal components of these time series and prioritized seasonal adjustment in its monthly PMI reports.

The Statistics and Economic Analysis Center of Iran Chamber of Commerce, Industries, Mines and Agriculture, the sponsor and coordinator of the survey, announces the whole economy PMI data in a report every month.

The headline PMI is a number from 0 to 100, such that over 50 shows an expansion of the economy when compared with the previous month. A PMI reading under 50 indicates contraction and a reading of 50 implies no change.

PMI is an index of the prevailing direction of economic trends, aiming to provide information about business conditions to company directors, analysts and purchasing managers.

Click on the image for better view

The “business activities” sub-index was estimated at 48.4 in the period under review, remaining below the neutral 50 mark for the 16th month in a row. While the pace of decline slowed compared with the preceding month, producers continued to face major disruptions. Unscheduled power cuts forced production stoppages and drove up costs, while supply chain bottlenecks – including higher raw material prices, delays in foreign currency allocation, customs issues and financing constraints – further reduced capacity.

The “new orders” sub-index also fell for the 17th consecutive month. Survey respondents cited weak household purchasing power due to chronic inflation and insufficient income growth, alongside heightened uncertainty over the economic and political outlook amid regional tensions and currency volatility. This has led consumers to delay non-essential purchases.

“Exports of goods and services” sub-index remained on a downward path during the month. “Employment” as another main sub-index continued to shrink, extending a sharp decline seen last month, with hiring falling to its lowest level in nearly five years, the survey showed.

|

INDEX

|

Ordibehesht1404 (Apr-May2025)

|

Khordad1404 (May-June2025)

|

Tir1404 (June-July2025)

|

|

PMI (seasonally adjusted)

|

50.3

|

42.9

|

47.3

|

|

business activities

|

48.1

|

45.5

|

48.4

|

|

new orders

|

49.6

|

38.5

|

46.1

|

|

suppliers’ delivery time

|

48.3

|

45.6

|

49.8

|

|

raw material inventory

|

49.1

|

46.0

|

45.4

|

|

employment

|

56.1

|

43.0

|

46.6

|

|

raw materials price

|

76.5

|

77.3

|

75.9

|

|

finished goods inventory

|

47.6

|

48.5

|

50.9

|

|

exports of goods and services

|

42.0

|

44.3

|

45.6

|

|

price of goods and services

|

61.2

|

59.9

|

56.7

|

|

consumption of energy carriers

|

57.8

|

43.7

|

48.6

|

|

sales of goods and services

|

52.6

|

43.2

|

50.8

|

|

expectations for next month economic activities

|

53.1

|

53.8

|

49.6

|