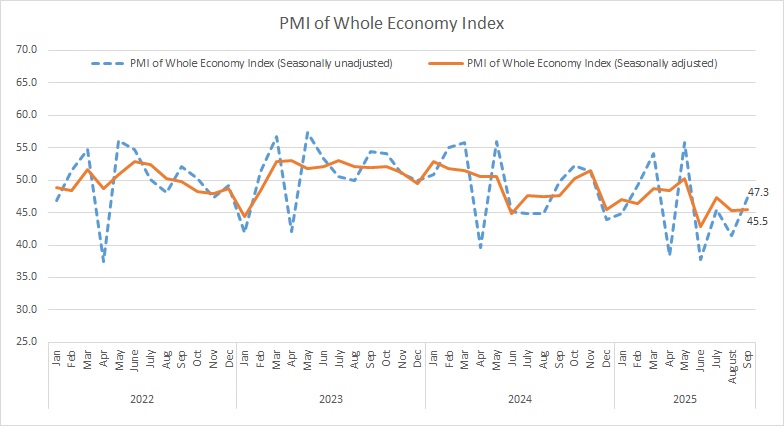

Iran Chamber of Commerce, Industries, Mines, and Agriculture (ICCIMA) has released the country’s latest Purchasing Managers’ Index (PMI) data for the fiscal month of Shahrivar (August 23 – September 22, 2025), showing that business conditions across the economy remained in contraction for the 18th straight month, despite a marginal improvement over the previous period.

The seasonally adjusted headline PMI for the whole economy rose slightly to 45.5 from 45.3 last month, signaling that the downturn persisted but at a somewhat slower pace.

Seasonal adjustment, or deseasonalization, is a statistical method used to remove the seasonal component from a time series, allowing for the independent analysis of trends and cyclical deviations. After preparing dozens of PMI (Purchasing Managers' Index) reports, the Research Center of Iran Chamber of Commerce, Industries, Mines, and Agriculture has now identified the seasonal components of these time series and prioritized seasonal adjustment in its monthly PMI reports.

The ICCIMA’s Statistics and Economic Analysis Center, the sponsor and coordinator of the survey, announces the whole economy PMI data in a report every month.

The headline PMI is a number from 0 to 100, such that over 50 shows an expansion of the economy when compared with the previous month. A PMI reading under 50 indicates contraction and a reading of 50 implies no change.

PMI is an index of the prevailing direction of economic trends, aiming to provide information about business conditions to company directors, analysts and purchasing managers.

Click on the image for better view

According to the new survey, output in both manufacturing and services continued to shrink in the month under review, with the “business activities” sub-index registering 45.3. Although the decline eased compared with August, it marked the 18th consecutive month of sub-50 readings, reflecting sustained weakness in business activity.

The “new orders” index also extended its downward trend for the 19th month in a row, pointing to weak demand across most sectors.

A persistent shortage of inputs remained a major constraint. The inventory of raw materials and purchased goods fell for the 13th consecutive month, hitting its lowest level in 31 months, since March 2023.

Employment conditions worsened further, with the “employment” sub-index dropping to 47.5, marking the fourth consecutive monthly decline and the fifth drop since the start of the fiscal year.

The inventory of finished goods or work-in-progress also fell to its lowest level in four months.

Business confidence remained bleak. The “expectations for future activity” index declined for the third consecutive month, reaching its lowest point since the launch of the survey 72 months ago.

|

INDEX

|

Tir1404 (June-July2025)

|

Mordad1404 (July-Aug2025)

|

Shahrivar1404 (Aug-Sep2025)

|

|

PMI (seasonally adjusted)

|

47.3

|

45.3

|

45.5

|

|

business activities

|

48.4

|

44.0

|

45.3

|

|

new orders

|

46.1

|

42.3

|

43.0

|

|

suppliers’ delivery time

|

49.8

|

48.5

|

49.4

|

|

raw material inventory

|

45.4

|

45.1

|

43.5

|

|

employment

|

46.6

|

49.2

|

47.5

|

|

raw materials price

|

75.9

|

76.3

|

78.2

|

|

finished goods inventory

|

50.9

|

52.4

|

48.1

|

|

exports of goods and services

|

45.6

|

42.8

|

44.9

|

|

price of goods and services

|

56.7

|

54.6

|

58.5

|

|

consumption of energy carriers

|

48.6

|

45.2

|

51.8

|

|

sales of goods and services

|

50.8

|

48.1

|

52.1

|

|

expectations for future activity

|

49.6

|

46.5

|

38.4

|