The Central Bank of Iran (CBI) says it is creating a financial mechanism similar to Europe’s INSTEX that will be unveiled “soon” in the face of US sanctios.

The top financial institution in Iran said on Saturday in a statement that Instrument in Support of Trade Exchage (INSTEX), created by Germany, France and the UK, “falls short of the Europeans’ commitment to prevent the JCPOA from failing.”

However, adds the statement, in order to show engagement, Central Bank of Iran will introduce a similar company, that is being created, to start cooperation with Europe.

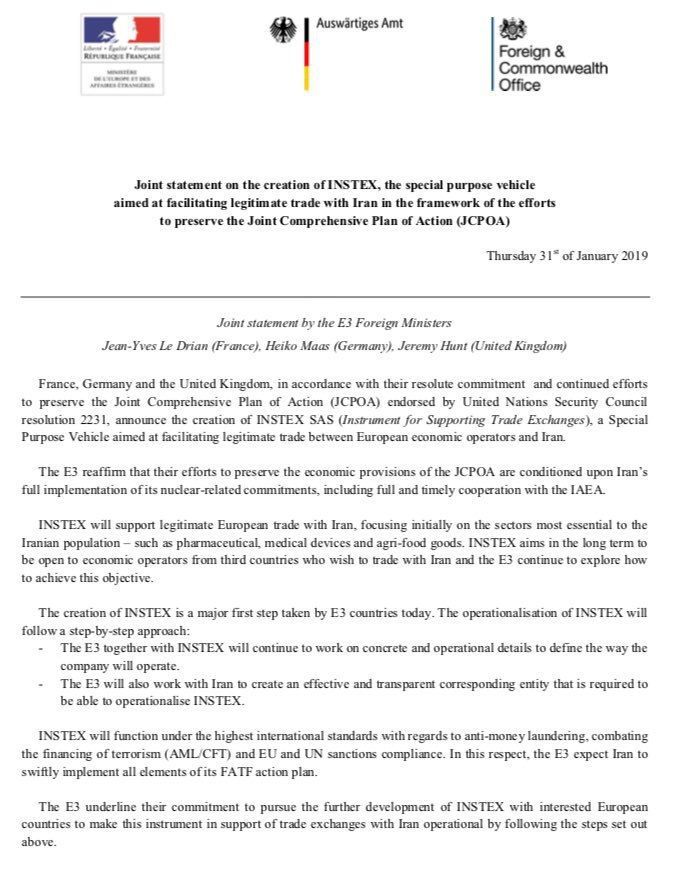

The European trio, that also signed the 2015 Iran nuclear deal, announced the creation of a Special Purpose Vehicle (SPV) on 31 January in a bid to allow uninterrupted trade between Iran and Europe in the face of unilateral US Sanctions. The payment channel is meant in its first phase to help export of European pharmaceuticals, medical device and agri-foods.

The Central Bank’s statement comes on the first day of the week in Iran after the Paris-based Financial Action Task Force (FATF) gave Tehran four more months- until June- to finally approve Combating Financing of Terrorism (CFT) and the Palermo Convention.

Late January, German, French and the British foreign ministers “expected” that Iran passes outstanding FATF-related bills to fast-track implementation of INSTEX.

A screenshot of the the E3 following the annoucement of INSTEX creation

The document's wording has drawn fierce criticism from wide range of Iran's politicial spectrum, making some key lawmakers go through a change of heart and threaten with voting against CFT and Palermo Convention.

INSTEX, has been registered at the address of France's Eonomy and Finance Ministry in Paris. German banker Per Fischer has been reportedly chosen for a period of six months to run it. Also, a senior UK diplomat is expected to head the Supervisory Board.

Former Commerzbank manager Per Fischer

Iran Chamber of Commerce, Industries, Mines and Agriculture (ICCIMA) that represents the country's private sector officially welcomed the move, promising to turn it into a huge success.