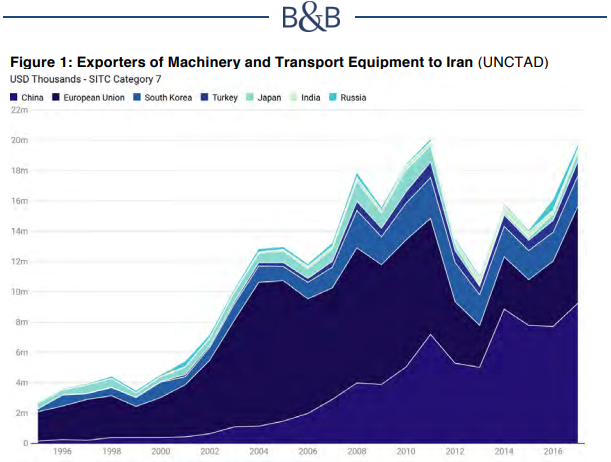

"Until 2011, the European Union was Iran’s primary source of industrial machinery and equipment, exporting USD 7.7 billion in equipment that same year. Chinese exports reached USD 7.2 billion, having grown from just USD 426 million a decade earlier, as Iran’s overall demand for industrial equipment grew," according to a special report published Monday by Bourse & Bazar website.

Ther report highlights that "it was the imposition of financial sanctions in 2012 which spurred China to overtake the EU28 as Iran’s primary trading partner in these categories. Chinese suppliers benefited from the fact that China’s Bank of Kunlun, owned by state oil giant CNPC, had been nominated to sustain trade with Iran in the face of US secondary sanctions as part of the strategic decision by China to continue purchasing Iranian oil in high volumes."

"By comparison, European banks proved reluctant to sustain even sanctions-exempt or licensed trade with Iran. Meanwhile, Iran’s oil exports to Europe fell precipitously, starving Iran of the foreign exchange revenue necessary to sustain import levels," the report finds.

Iran turned to major Asian powers, China and India, in the face of those sanctions because it believed that "they could now provide the same technological and financial support as Western countries, but without making “economic relations conditional on ‘acceptable’ political processes or behavior.”

In the wake of the 2015 international treaty on Iran's nuclear programme, also known as the Joint Comprehensive Plan of Action (JCPOA), Tehran sought to balance direct foreign investment from both West and East. For example, "France’s Total was awarded the first major oil and gas contract in 2016, it was as part of a consortium including China’s CNPC. Italy’s Ferrovie was contracted to engineer a high speed railway between Tehran and Isfahan which was to be built by the China Railway Engineering Corp.4 Iranian state-owned firms Iran Khodro and SAIPA restarted partnerships with European automakers Renault and PSA Peugeot Citroen, and truck makers Volvo and Daimler, but also sought to expand the presence of Chinese players such as Chery and Dongfeng that had taken market share from the Europeans in the sanctions period."

However, there were certain investment or export categories that Iran couldn't replace Chinese products with their similiar European ones. "Iran imports nearly USD 900 million in medicine and medical devices from the EU28 each year. Chinese exports amount to just under USD 200 million in the same categories," the report detials.

A screenshot of a figure showing export of industrial machinery to Iran (Photo: Bourse and Bazar report)

"Europe’s edge in technology and intellectual property in pharmaceutical products and medical devices means that substitutes cannot be sourced from China. Add to this the fact that European brands hold stronger resonance with Iranian consumers and that European multinationals had made equity investments in local manufacturing capacity, whereas Chinese competitors have not, and it is clear that Iran could not reasonably seek to eliminate its dependence on trade with Europe as a means to de-risk."

The only viable strategy has been diversification. But in pursuing diversification, it seems that Iran may have overlooked the extent to which its trade ties with China could prove as politically exposed and contingent as those with Europe.

Sanctions return

The website, especialising in "Iran's business diplomacy", points out that Europe, that refused to walk out of the nuclear deal, took two measures to keep up trade with Iran, bypassing the US sanctions. "First, the European Union updated the blocking regulation, a largely symbolic law which makes it illegal for European companies to comply with extraterritorial sanctions. Second, the governments of France, Germany, and the United Kingdom began developing a special purpose vehicle (SPV), a mechanism intended to help sustain European trade with Iran by reducing the need for banks to facilitate cross-border transactions."

The report believes that Iran wore out thin its political efforts to keep up pressue on Europe to establish the SPV which resulted in Tehran fail to pay attention to China "in part as well due to reassuring statements from Chinese authorities."

Despite such heart-warming remarks from Beijing, "commercial actors were hearing a different message," it says. For an instance, "in the months following Trump’s withdrawal from the JCPOA, rumors began to swirl in Iran that China’s Bank of Kunlun was reconsidering its Iran business. Trade with Chinese partners appeared to be slowing."

The Great Wall of China

"The first clear warning sign came in September, when the value of Chinese imports of Iranian oil fell to USD 1.16 billion from USD 1.78 billion in the previous month. Imports fell further in October to just USD 628 million, before rebounding to USD 925 million in November and USD 1.06 billion in December. Just a few days before the reimposition of secondary sanctions on November 4, China was among eight countries that received a Significant Reduction Exemption (SRE) from the US government which permitted the continued importation of Iranian oil if the proceeds of Iran’s sales were exclusively used for the purchase of humanitarian goods such as foodstuffs and medicine," Bouse and Bazar writes.

"The decision to pursue an SRE presaged an announcement from Bank of Kunlun which confirmed the rumours of a reconsideration. The bank informed clients it was putting all Iran-related business on hold pending a change in policy, effectively shutting the main financial channels through which the majority of China-Iran trade was conducted. In December, it was announced that the bank would only process humanitarian trade, in a move consistent with the terms of the SRE, meaning that Iranian importers of Chinese machinery and other “sanctionable” goods could no longer pay for orders," the report says.

It goes on to explain that "October 2018 was the first month in many years in which EU28 exports to Iran exceeded those from China, in part because of the bumper effect of European suppliers trying to fulfill orders before the reimposition of sanctions on November. With sanctions in place, European exports fell as expected to just over USD 550 million from USD 1.3 billion."

"More surprisingly, Chinese exports also fell dramatically, down to USD 639 million in November, before falling further to just USD 391 million, the lowest monthly level in at least five years based on the available data," the report stresses.

"Exports have fallen by a staggering 68 percent since October. When considering that some of the cargoes tabulated by China’s customs administration may have been paid for in advance, it is likely that the total value of Chinese exports paid for in the month of December is even lower. Though sanctions hit late in 2018, total exports were USD 1.4 billion, a level last seen in 2013."

Even Chinese imports of Iran crude have been affected by the Asian power although it was saying over and again that it backs Iran under the restored sanctions. "Chinese refiners will import less crude under new terms for the same reason that Bank of Kunlun will facilitate payments for fewer exports—a change in government policy," Bourse and Bazar says.

And although China imported more Iranian oil, the exports to Iran fell and that is due to restrictions by the Bank of Kunlun. "Since 2014, on average, Chinese exports to Iran have tended to exceed imports by of USD 7.5 million per month. Put another way, while there is high volatility month-to-month, Iran tended to spend more than it earns in China in a given year, suggesting strong demand for Chinese imports. In 2018, this pattern reversed. Chinese imports have exceeded exports by an average of USD 584 million per month, driven in part by bumper purchases of Iranian crude this summer at a time when export totals had begun their now accelerating decline," according to the report.

"It is also notable that exports of vehicles and transportation equipment—one of the largest export categories—fell as a proportion of total exports from a monthly average of 19 percent to just 3.5 percent in the last two months, a fall consistent with a restriction on goods that would be considered sanctionable under US secondary sanctions," it highlights.

Bourse and Bazar mentions that "the data does support growing concerns among Iranian industrialists that the breakdown in China-Iran trade is leading to shortages in key manufacturing inputs."

"On face, the significant fall in China-Iran trade appears inconsistent with the Chinese foreign ministry’s assurances that China remains committed to its commercial relationship with Iran and its opposition to the extraterritorial nature of US sanctions," the report stresses.

US trade war with China, complicated by the arrest of Huawei CFO in Canada, Beijing's waiting for the European Union to lead political and economic measures regarding Iran, FATF's mutural review of China's standards in Anti-Money-Laundering (AML) and Combatting the Financing of Terrorism (CFT), Chinese companies fear of US retaliatory measures as well as China's growing military and economic alliance with Pakistan have all played a very significant role in China's reluctance to directly bypass the sanctions, the report says.

The special report concludes that "addition of pressures stemming from China will further weaken Iran’s economy. The fall in exports of food, medicine, and consumer goods from Europe will contribute to inflation, while the fall in exports of machinery and equipment from China will lead to production slowdowns and layoffs in the manufacturing sector."

Bourse and Bazar warns of "devastating and destablising" consequences of unemployment which would result from a sharp decline in Chinese export of industrial machinery. "If the nuclear deal collapses due to extraordinary economic pressures in Iran, China may be to blame," it cautions.